Golf Clubs Business Expense . Know the types of business expenses that are tax deductible to reduce your. Many professionals hit the links with. Business expenses are the costs incurred to run your business. Wondering if that golf membership can swing as a business expense? As outlined in the updated tax regulations, membership dues paid to clubs for business, recreation, social, or leisure purposes are. Ever wondered if your love for golf could actually be a savvy business move? Golf clubs, tee times and other expenses are included in a bill. A question cpas often hear from our clients preparing their business taxes is whether they can deduct the club dues they pay to golf courses and other businesses for. Many professionals hit the greens for. With the rise in popularity of golf memberships and the increasing range of corporate memberships on offer to local.

from www.chegg.com

Know the types of business expenses that are tax deductible to reduce your. Golf clubs, tee times and other expenses are included in a bill. Many professionals hit the greens for. Wondering if that golf membership can swing as a business expense? Ever wondered if your love for golf could actually be a savvy business move? A question cpas often hear from our clients preparing their business taxes is whether they can deduct the club dues they pay to golf courses and other businesses for. Business expenses are the costs incurred to run your business. Many professionals hit the links with. With the rise in popularity of golf memberships and the increasing range of corporate memberships on offer to local. As outlined in the updated tax regulations, membership dues paid to clubs for business, recreation, social, or leisure purposes are.

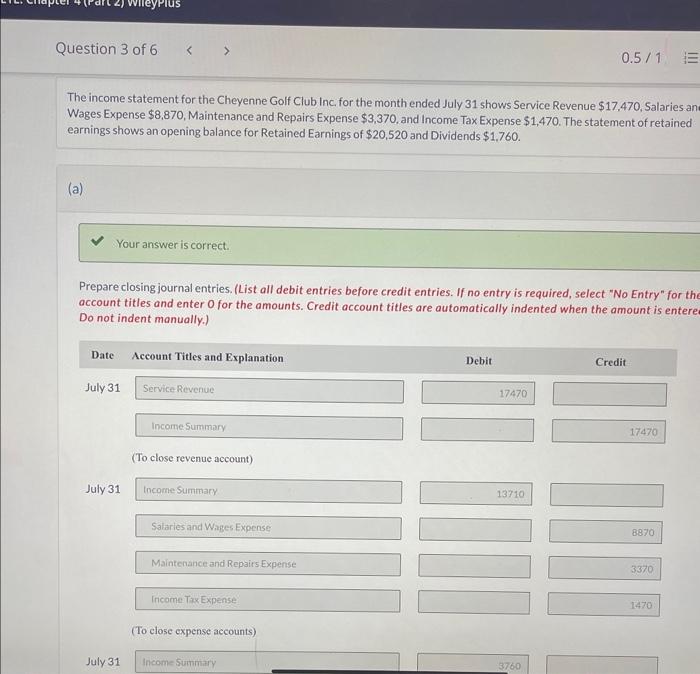

Solved The statement for the Cheyenne Golf Club Inc.

Golf Clubs Business Expense Business expenses are the costs incurred to run your business. Many professionals hit the greens for. With the rise in popularity of golf memberships and the increasing range of corporate memberships on offer to local. Ever wondered if your love for golf could actually be a savvy business move? Know the types of business expenses that are tax deductible to reduce your. Wondering if that golf membership can swing as a business expense? As outlined in the updated tax regulations, membership dues paid to clubs for business, recreation, social, or leisure purposes are. Many professionals hit the links with. Golf clubs, tee times and other expenses are included in a bill. Business expenses are the costs incurred to run your business. A question cpas often hear from our clients preparing their business taxes is whether they can deduct the club dues they pay to golf courses and other businesses for.

From templates.hilarious.edu.np

Conference Budget Template Golf Clubs Business Expense Business expenses are the costs incurred to run your business. Know the types of business expenses that are tax deductible to reduce your. Many professionals hit the links with. With the rise in popularity of golf memberships and the increasing range of corporate memberships on offer to local. Golf clubs, tee times and other expenses are included in a bill.. Golf Clubs Business Expense.

From dandagolf.com

Different Types of Golf Clubs & Their Uses D&A Golf Shop Golf Clubs Business Expense As outlined in the updated tax regulations, membership dues paid to clubs for business, recreation, social, or leisure purposes are. Know the types of business expenses that are tax deductible to reduce your. Business expenses are the costs incurred to run your business. Many professionals hit the greens for. Golf clubs, tee times and other expenses are included in a. Golf Clubs Business Expense.

From mygolfspy.com

How To Clean Golf Clubs MyGolfSpy Golf Clubs Business Expense Know the types of business expenses that are tax deductible to reduce your. Many professionals hit the greens for. Wondering if that golf membership can swing as a business expense? Ever wondered if your love for golf could actually be a savvy business move? With the rise in popularity of golf memberships and the increasing range of corporate memberships on. Golf Clubs Business Expense.

From www.maxmedal.com

List of Types of Golf Clubs & Their Names and Uses Golf Clubs Business Expense Many professionals hit the links with. Ever wondered if your love for golf could actually be a savvy business move? Business expenses are the costs incurred to run your business. Wondering if that golf membership can swing as a business expense? A question cpas often hear from our clients preparing their business taxes is whether they can deduct the club. Golf Clubs Business Expense.

From www.youtube.com

How much does it cost to play golf? Complete guide to golf expenses Golf Clubs Business Expense Ever wondered if your love for golf could actually be a savvy business move? Business expenses are the costs incurred to run your business. Know the types of business expenses that are tax deductible to reduce your. A question cpas often hear from our clients preparing their business taxes is whether they can deduct the club dues they pay to. Golf Clubs Business Expense.

From www.chegg.com

Solved The statement for Salt Creek Golf Club for the Golf Clubs Business Expense Know the types of business expenses that are tax deductible to reduce your. Golf clubs, tee times and other expenses are included in a bill. With the rise in popularity of golf memberships and the increasing range of corporate memberships on offer to local. Business expenses are the costs incurred to run your business. Many professionals hit the links with.. Golf Clubs Business Expense.

From www.youtube.com

How I Ship Golf Clubs beginner guide for Irons, Iron set, Drivers Golf Clubs Business Expense Business expenses are the costs incurred to run your business. Many professionals hit the links with. As outlined in the updated tax regulations, membership dues paid to clubs for business, recreation, social, or leisure purposes are. A question cpas often hear from our clients preparing their business taxes is whether they can deduct the club dues they pay to golf. Golf Clubs Business Expense.

From db-excel.com

Simple Club Accounts Spreadsheet Google Spreadshee simple club accounts Golf Clubs Business Expense Golf clubs, tee times and other expenses are included in a bill. Wondering if that golf membership can swing as a business expense? Ever wondered if your love for golf could actually be a savvy business move? As outlined in the updated tax regulations, membership dues paid to clubs for business, recreation, social, or leisure purposes are. Know the types. Golf Clubs Business Expense.

From bvmsports.com

Golf Club Etiquette A Guide to Guest Conduct, Caddie Fees, and Event Golf Clubs Business Expense Many professionals hit the greens for. With the rise in popularity of golf memberships and the increasing range of corporate memberships on offer to local. A question cpas often hear from our clients preparing their business taxes is whether they can deduct the club dues they pay to golf courses and other businesses for. Know the types of business expenses. Golf Clubs Business Expense.

From www.chegg.com

Solved Brief Exercise 46 The Statement For Whispe... Golf Clubs Business Expense With the rise in popularity of golf memberships and the increasing range of corporate memberships on offer to local. Ever wondered if your love for golf could actually be a savvy business move? Wondering if that golf membership can swing as a business expense? Many professionals hit the links with. Business expenses are the costs incurred to run your business.. Golf Clubs Business Expense.

From www.youtube.com

Measuring Golf Clubs / Correct length for you? YouTube Golf Clubs Business Expense A question cpas often hear from our clients preparing their business taxes is whether they can deduct the club dues they pay to golf courses and other businesses for. Many professionals hit the greens for. Golf clubs, tee times and other expenses are included in a bill. Wondering if that golf membership can swing as a business expense? As outlined. Golf Clubs Business Expense.

From www.chegg.com

Solved The statement for Salt Creek Golf Club for the Golf Clubs Business Expense Many professionals hit the greens for. Wondering if that golf membership can swing as a business expense? Ever wondered if your love for golf could actually be a savvy business move? Golf clubs, tee times and other expenses are included in a bill. Know the types of business expenses that are tax deductible to reduce your. With the rise in. Golf Clubs Business Expense.

From www.chegg.com

Solved The statement for the Cheyenne Golf Club Inc. Golf Clubs Business Expense Know the types of business expenses that are tax deductible to reduce your. A question cpas often hear from our clients preparing their business taxes is whether they can deduct the club dues they pay to golf courses and other businesses for. Many professionals hit the links with. With the rise in popularity of golf memberships and the increasing range. Golf Clubs Business Expense.

From financialmodeltemplates.com

Golf Club Business Plan SimpleToUse Golf Clubs Business Expense Many professionals hit the links with. Many professionals hit the greens for. Ever wondered if your love for golf could actually be a savvy business move? As outlined in the updated tax regulations, membership dues paid to clubs for business, recreation, social, or leisure purposes are. Know the types of business expenses that are tax deductible to reduce your. A. Golf Clubs Business Expense.

From golfeducate.com

5 Types Of Golf Clubs And Their Uses (Beginner’s Guide) Golf Educate Golf Clubs Business Expense A question cpas often hear from our clients preparing their business taxes is whether they can deduct the club dues they pay to golf courses and other businesses for. Golf clubs, tee times and other expenses are included in a bill. As outlined in the updated tax regulations, membership dues paid to clubs for business, recreation, social, or leisure purposes. Golf Clubs Business Expense.

From db-excel.com

Monthly Expenses Spreadsheet Template Excel — Golf Clubs Business Expense Many professionals hit the greens for. As outlined in the updated tax regulations, membership dues paid to clubs for business, recreation, social, or leisure purposes are. A question cpas often hear from our clients preparing their business taxes is whether they can deduct the club dues they pay to golf courses and other businesses for. With the rise in popularity. Golf Clubs Business Expense.

From www.pinterest.com

PXG 0311 GEN4 Irons in 2021 Pxg, Golf, Club Golf Clubs Business Expense Know the types of business expenses that are tax deductible to reduce your. Many professionals hit the links with. As outlined in the updated tax regulations, membership dues paid to clubs for business, recreation, social, or leisure purposes are. Many professionals hit the greens for. Wondering if that golf membership can swing as a business expense? Business expenses are the. Golf Clubs Business Expense.

From byrncliff.com

4+ Things You Should Do To Enjoy Golf More Byrncliff Golf Resort and Golf Clubs Business Expense Wondering if that golf membership can swing as a business expense? Many professionals hit the greens for. With the rise in popularity of golf memberships and the increasing range of corporate memberships on offer to local. Many professionals hit the links with. Business expenses are the costs incurred to run your business. A question cpas often hear from our clients. Golf Clubs Business Expense.